By choosing our invoice discounting software, you are entering the world of state-of-the-art technology and improved business operations, where a high-quality solution can make a significant difference between success and failure.

Invoice discounting software by STAGE11

Stage11 provides cloud-based FinTech solutions out of the box. Some main features you can expect from Stage11 invoice discounting software are:

- Fully automated invoice discounting

- Integrated KYC/KYB and risk scoring model

- Online electronic-ID verification and sign-off

- Instant online pricing & invoice offers

- Easy integration with accounting or core-banking software

- Open API connectivity = build on top of our solution

- Automated import of existing Excel spreadsheets and databases

What is invoice discounting?

Invoice discounting is a way to use unpaid invoices as collateral for a loan. The loan is traditionally issued by a finance or factoring company that makes money from interest rates on the loan and other maintenance fees. Invoice discounting is an excellent opportunity for SMEs to find quick funds and grow their business network more quickly and efficiently.

When using the Stage11 invoice discounting solution, there are features like direct online pricing and fast approval processes. You can immediately receive the information regarding the costs and benefits of discounting to make the best decision to move your business forward. Traditional factoring usually means longer waiting periods, more fees and less transparency. This financing model surpasses traditional banking due to many reasons, including:

- Greater agility and flexibility

- Retained control over the sales ledger (compared to invoice factoring)

- No effect on business relations between seller and buyer

- No asset as collateral

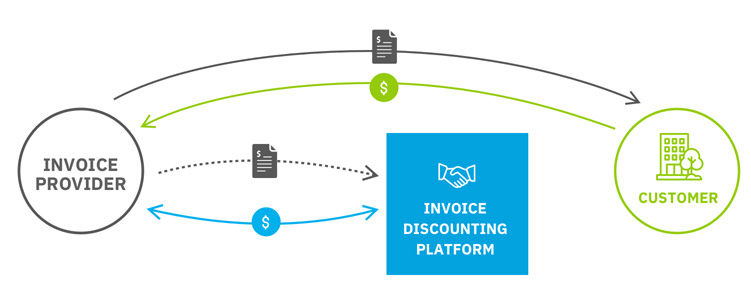

The practical process

The invoice discounting process starts out by sending invoices to customers as usual, including the amount due and payment date. Next, the invoice discounting platform automatically generates an offer for the same invoice, which upon acceptance is verified by the platform administrator. You receive the cash for your business expenses usually within a few hours. When the invoice is paid, you repay this loan to the discounting platform provider, including additional fees and interest rate. Invoice discounting is confidential in the sense that your customer will not see that you are using it.

Differences between invoice discounting and factoring

Invoice discounting and factoring have many things in common. One major difference is how the customers notice it. When using invoice discounting, you are still in control of collecting the payments. Invoice discounting is generally an option for companies with a bigger turnover, as it has higher credit requirements and higher costs. A common case is that businesses that grow quickly use invoice discounting to speed up cash flow for new investments. Factoring is different, since the factor takes over the credit control and collection process. No matter the choice, a quality platform with the right software is important. With Stage11 you get access to both options combined = factoring software + invoice discounting software.

Cloud-based SaaS solution platform

Our invoice discounting software is a cloud-based SaaS (Software as a Service) solution. Depending on the client`s needs, it can also be offered as a Private Cloud (on-premise), with dedicated server resources. This means that the software does not need to be installed locally. A cloud-based solution means flexibility and mobility. Security and loss prevention are two other good reasons to use a cloud-based platform. Hosting operations will be provided as close as possible to your business and target market. Cloud-based SaaS solutions also mean that you only pay for using the service, not full ownership of the platform.

You have the one-time opportunity to get our software installation free of charge. If you wish to further customize it to your individual requirements, a one-off fee will be charged. Ongoing maintenance will be presented as a recurring monthly fee as long as you are using the platform.

White label invoice discounting software

Stage11 platforms are all white label solutions. We provide the platform, but you can still brand it using your own brand. This allows you to use our software expertise to showcase and grow your brand online. We are also open to the possibility of providing the application souce code under specific terms.