Crowdfactoring has just entered the scene, and it has already become an attractive solution for SMEs, helping them find short-term capital by selling their invoices.

This financing model is highly beneficial to both SMEs and investors, especially if they choose the best-of-breed, fully interactive, and secure crowdfactoring platform to handle the entire process.

STAGE11 Crowdfactoring Software: A Revolutionary FinTech Solution for SME financing

The Stage11 Crowdfactoring software features the most advanced technology for the best SaaS experience in the financial sphere, making it the number one choice among clients from the emerging markets.

Besides a high-performance system for a seamless connection between all the four end participants of crowdfactoring, Stage11 offers a stellar user experience and fosters business growth through the following features and benefits:

- Quick and simple online registration

- Electronic ID verification and sign-off

- Cutting-edge tools for customer due diligence (Know Your Customer/KYC)

- Direct deposit using Stripe account

- Cross-border investments

- Interactive dashboards

- Open API connectivity

- Automated tax reporting (RegTech)

- Integrated standard ledger

Stage11 stands out from the crowd for its cloud-based and white-label solutions delivered to our clients across the Middle East, Africa, and Europe.

What is Crowdfactoring?

Crowdfactoring is a game-changing form of business financing that allows companies to sell and assign a large number of invoices to investors at a discount.

The very idea of crowd factoring is rooted in invoice factoring, which helps businesses find short-term capital for selling their receivables. Still, invoice factoring is not considered a loan.

Instead, it is a way to sell invoices to a factor for an additional fee. Crowdfactoring follows the same business scheme, but it is a more complex financing model than invoice factoring as it includes external investors in the invoice financing process.

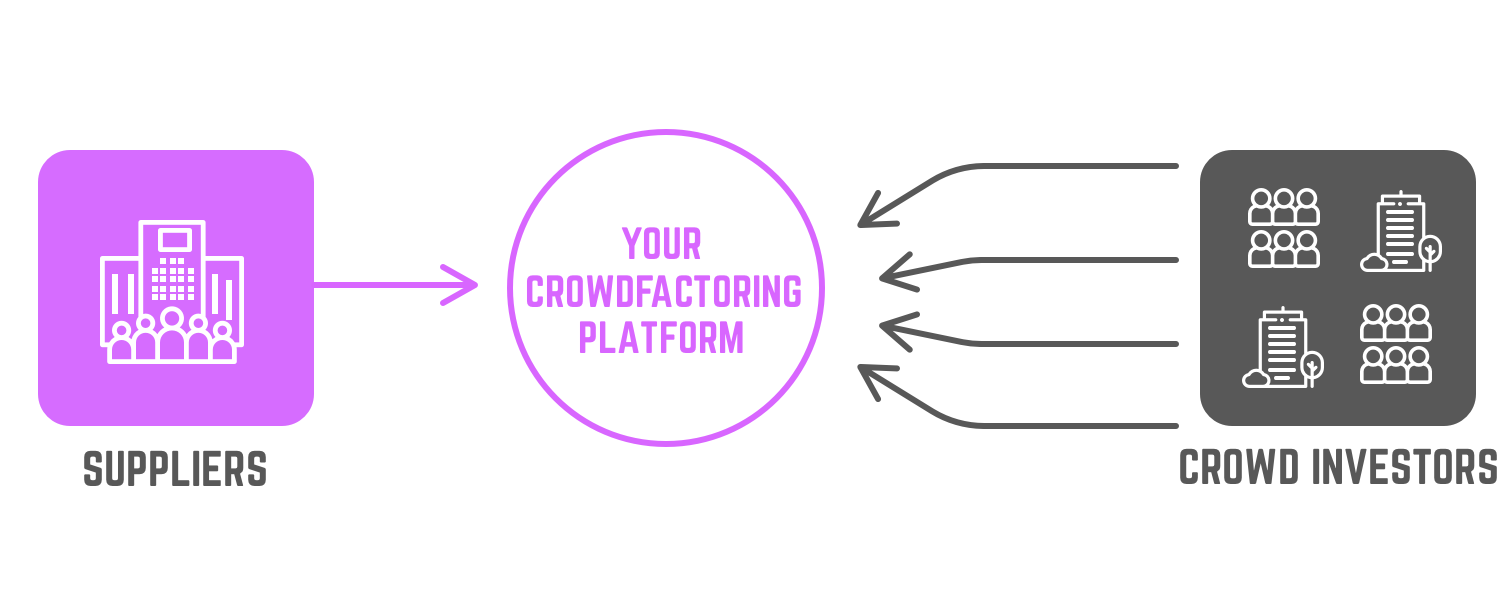

Who Participates in Crowdfactoring?

There are four major roles in crowdfactoring that close the financial structure:

- Supplier: Any company that sells its invoices to a marketplace to receive the advance payment.

- Debtor: A supplier’s client, which is a company that pays the invoice.

- Factor: A crowdfactoring platform owner that provides an online platform where companies and investors meet to sell/buy receivables. In our case, it’s a white-label, Stage11 Crowdfactoring platform.

- Investors: Companies or individuals that invest in invoices using the crowdfactoring platform.

Why Crowdfactoring?

A cutting-edge digital platform allows the factor to create a seamless connection between investors and companies selling receivables (suppliers).

Both investors and suppliers will benefit from a simple software-as-a-service (SaaS) solution that offers quick, safe, and entirely transparent invoice handling.

Aside from having full control over secure and short-term investments, SMEs (suppliers) will experience a broad range of advantages of a crowdfactoring platform. For instance:

For Companies - SMEs

- Agile and recurrent service: SMEs can sell their invoices to improve their cash flow quickly and efficiently.

- Suitable for small and midsize businesses: The crowd factoring service is tailored for small and midsize businesses, which can use the crowdfactoring platform limitlessly.

- Fully transparent: The platform’s terms and conditions are fully transparent, without hidden sections or small print.

- Supply chain finance (Reverse factoring): SCF allows suppliers to receive early payment on their invoices. This model mitigates the risk of supply chain disruption, enabling the suppliers to improve their working capital.

- No collateral asset: Suppliers don’t need collateral to enter the crowdfactoring process.

- Confidentiality: The crowdfactoring platform provides a safe and confidential environment, ensuring all sensitive data remains protected.

- Fast working capital injection: A company will receive a capital injection soon after the process has begun.

For Investors

- Short-term investment: Both companies and individuals who invest in invoices will benefit from the short-term investment. It allows them to return the invested money usually within 60-90 days.

- Increased profitability: Contributors can make a significant profit on an annual basis.

- Quick and easy diversification: It is possible to diversify between different suppliers, debtors, and invoices to lower the risks.

- Minimal investment: Investors can start investing in invoices with as much money as they want.

For Factor

- Simple, white-label solution: The crowdfactoring platform is a simple way to handle various invoices and clients. Since the administration quantity is quite high in this process, it may be hard to handle it without a reliable SaaS solution.

- Stabile usage: A complex SaaS platform minimizes the risk of human errors, delivering the utmost performance and stellar user experience.

- Technical complexity: The most advanced FinTech solutions allow the factor to experience a blend of comprehensive coding and an intuitive interface.

- Easy to use: A factor has the opportunity to enjoy a high-tech solution, top-notch UX design, and a user-friendly web application for more seamless daily operations.

Cloud-Based SaaS (Software-as-a-Service)

The cloud-based software-as-a-service model is packed with benefits, primarily since it helps reduce your ‘time to market’ (TTM). Besides, the cloud-based concept allows you to use your crowd factoring software without time-consuming installations and upgrades while enjoying rich integration options and enhanced scalability. A stable Internet connection is the only requirement.

The best thing about choosing a cloud-based SaaS solution is that you don’t pay for the ownership of the platform but the service you’re using. While installation and initial customization are a one-time cost, ongoing maintenance means paying a small monthly fee as long as you’re using the platform.

White-Label Crowd Factoring Platform

Our white-label crowd factoring system allows you to brand the platform as your own. You can later use it to increase your brand’s visibility while harnessing the benefits of our platform’s state-of-the-art innovation and flexibility.