Lleva tu negocio a lo más alto con nuestra avanzada plataforma de reverse factoring. Nuestra solución intuitiva te permite optimizar fácilmente la gestión del capital de trabajo, al mismo tiempo que mejoras las relaciones con tus cedentes y el flujo de caja. Únete a la creciente comunidad de empresas que están transformando la financiación de su cadena de suministro con nuestra plataforma robusta y segura.

¿Qué es el Reverse Factoring?

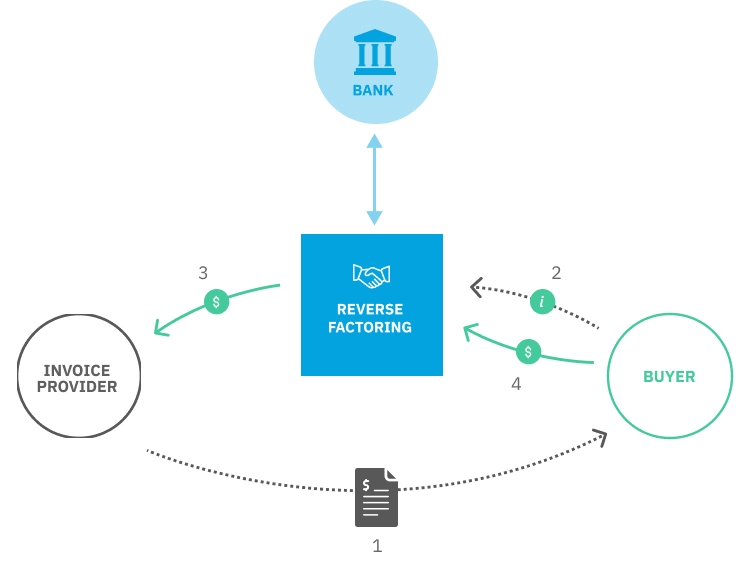

A diferencia del factoring tradicional o la financiación de facturas, el reverse factoring está impulsado por el cliente: es el cliente quien inicia el proceso y una entidad financiera paga al cedente de forma anticipada, mientras que el cliente liquida la factura en una fecha acordada posteriormente.

Este enfoque fortalece la liquidez de los cedentes y mejora el flujo de caja sin afectar su crédito, y a menudo resulta en condiciones de financiación más favorables gracias al perfil crediticio más sólido del comprador.

¿Por qué elegir la plataforma de reverse factoring de Stage11?

Si estás buscando un proveedor de software que ofrezca soluciones de reverse factoring personalizadas, has llegado al lugar correcto. Nuestra filosofía es facilitarte el trabajo, garantizando al mismo tiempo la seguridad y el cumplimiento normativo. Nuestra plataforma ofrece un ecosistema completo para que no tengas que preocuparte por tareas manuales tediosas, riesgos de seguridad o las complejidades de desarrollar una plataforma financiera.

Con nuestra solución de reverse factoring, puedes eliminar interrupciones por tareas manuales, mejorar la transparencia y ofrecer a los cedentes una forma fluida y segura de acceder a pagos anticipados en cualquier momento y desde cualquier lugar.

En Stage11, la seguridad es una prioridad. Entendemos los desafíos que implica operar una plataforma de reverse factoring en línea y, por eso, ofrecemos herramientas de cumplimiento integradas, incluyendo procesos KYC, AML y KYB adaptados a la normativa de tu región. Nuestra plataforma garantiza transacciones transparentes con respuestas inmediatas y precios directos - sin intermediarios, sin demoras. Gestionar la financiación de tu cadena de suministro nunca fue tan fácil ni tan seguro.

Las ventajas del reverse factoring para tu negocio

Gestionar el capital de trabajo y las relaciones con los cedentes es fundamental para el éxito empresarial. El reverse factoring empodera tanto a compradores como a cedentes, al garantizar que los cedentes mantengan un flujo de caja constante, mientras los compradores obtienen la flexibilidad de extender los plazos de pago sin afectar la liquidez del proveedor.

Este enfoque representa una alternativa atractiva a los préstamos bancarios tradicionales o líneas de crédito, especialmente para proveedores que pueden enfrentar dificultades para obtener financiación asequible por cuenta propia. Dado que el reverse factoring suele estar respaldado por la calificación crediticia del comprador, los costos de financiación suelen ser considerablemente más bajos en comparación con préstamos solicitados directamente por el proveedor.

Los bancos también se benefician de las plataformas de reverse factoring al acceder a oportunidades de financiación a corto plazo y bajo riesgo, respaldadas por la solvencia de grandes compradores corporativos. Estas soluciones permiten a los bancos ampliar su oferta de servicios a clientes corporativos, fortalecer los ecosistemas de proveedores y generar ingresos por comisiones mediante una infraestructura digital, escalable y segura.

Nuestra plataforma simplifica el reverse factoring al automatizar flujos de trabajo, reducir la carga administrativa y mejorar la eficiencia operativa. Con interfaces intuitivas, seguridad de nivel empresarial y análisis avanzados, nuestra solución permite tanto a bancos como a empresas desbloquear nuevas eficiencias y generar valor en la financiación de la cadena de suministro.

Descubre lo que nos hace diferentes

Además de la funcionalidad principal de reverse factoring, nuestra plataforma incluye:

- Flujos de trabajo completamente automatizados para la incorporación y aprobación de facturas

- Modelos avanzados de puntuación de riesgo y análisis crediticio

- Precios de financiación instantáneos y transparentes para facturas aprobadas

- Verificación electrónica de identidad global™

- Integración API fluida con sistemas ERP, contabilidad y CRM

- Paneles interactivos con información en tiempo real

- Soporte multilingüe y multimoneda

- Portal para proveedores que facilita la presentación de facturas y el seguimiento de pagos

- Cálculo instantáneo de cotizaciones basado en el crédito del comprador, el perfil del cedente y los términos de la factura

En Stage11, damos prioridad a un rápido tiempo de lanzamiento al mercado (TTM) para que puedas poner en marcha tu programa de reverse factoring de manera rápida y eficiente.

¿Interesado/a en crear tu propia plataforma de reverse factoring o en explorar si esta solución se adapta a las necesidades de tu negocio? No dudes en contactarnos a continuación: estamos aquí para ayudarte a desbloquear nuevas oportunidades.